Jim Isbell represents corporations, insurance companies, contractors and manufacturers in litigation relating to: toxic and environmental issues, insurance questions, commercial disputes, construction/construction defect, and, additionally, claims relating to both the maritime and energy fields.

Jim has handled cases involving complex contract disputes, insurance issues, construction and operation of chemical plants, and other oil and gas related facilities, both onshore and offshore. He also is responsible for cases arising from activities related to the construction of various plants, facilities, and buildings; product failure and design deficiencies; explosions/fire related investigation and litigation, including the massive administrative actions, legislative investigations, and tort claims arising from the chemical release and explosion at the Phillips Petroleum plant in October 1989.

Representative Experience

Obtained summary judgment for a property owner/hotel in a lawsuit asserting claims for sexual assault and negligence claims involving an employee and a minor.

Obtained judgment and recovery in a contract dispute and fraud case between two corporations.

Obtained summary judgment for an insurance agent/broker of a national insurance carrier involving alleged negligence, forgery and misrepresentation claims, including claims for bad faith and breach of contract, relating to the issuance and denial of payments pursuant to a life insurance policy.

Obtained summary judgment on behalf of a Fortune 500 tire company in a personal injury lawsuit brought by railroad employees, asserting negligence and other claims associated with a collision between a train and a truck at a crossing.

Obtained judgment/ruling in an arbitration between two Fortune 500 companies relating to interpretation of and responsibilities under their separate contracts.

Defended a Fortune 50 company for insurance coverage and bad faith claims associated with policies alleged to provide coverage for multiple class action and multi-district suits across the United States.

Defended and obtained dismissal for Fortune 500 defendant sued for personal injuries resulting from an assault involving employees of its subcontractors.

Defended and obtained a judgment of no liability or bad faith for a Fortune 50 company with respect to insurance coverage for an alleged product liability case involving property damage claims associated with the failure of the equipment to perform as marketed.

Represented a Fortune 50 insurance company with respect to a coverage dispute with another insurance company over duty to defend and duty to pay for a multi-million dollar settlement involving multiple deaths.

Defended a Fortune 50 company sued for insurance coverage and bad faith claims arising from policies issued to an international pharmaceutical company with respect to suits relating to thousands of product liability claims across the United States.

Defended large construction company with respect to explosions/fire litigation, including the over 2500 claims relating to tort, toxic and environmental injuries and damages arising from the chemical release and explosion at the Phillips Petroleum plant.

Represented a Fortune 50 company relating to intellectual property claims against a national airline, including those associated with trademark and copyright issues.

Defended property owner which was also acting as the general contractor for a large warehouse and office project. Employee of rigging sub-contractor fell from structure when a support column partially gave way, suffered substantial injuries in the fall (over 20 surgeries with in excess of $250,000.00 in past medical).

Defended large manufacturer/supplier of excavation equipment for deaths resulting from cave-in at construction project.

Defended a national steel testing company in suits involving numerous death, injury and property damage claims filed in Texas and Louisiana resulting from the rupture of a steel tank releasing molten chemical and paper waste which engulfed several bystanders and burned others in the area.

Defended large construction company in a property damage case involving a multi-million claim, when the rigging failed and a large (several ton) screen, used in a chemical reactor involved in the production of chemicals, was dropped.

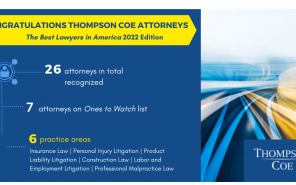

Professional Recognition

Listed for Construction Law

AV Peer Review Rated

Top Rated Lawyer in Construction

Related Resources

Related Services

Publications & Speaking Engagements

Education, Admissions & Activities

Education

South Texas College of Law

J.D., magna cum laude, 1983

The University of Texas at Austin

B.B.A., 1977

Bar Admissions

Texas

1983

Court Admissions

United States Court of Appeals

Fifth and Eleventh Circuit

United States District Court of Texas

Northern, Southern, Eastern, Western

Professional and Community Activities

Houston Bar Association

American Bar Association

Texas Association of Defense Counsel

Defense Research Institute

South Texas College of Law

Alumni Association Board of Directors, 1993-1999