Jack M. Cleaveland Jr.

Dallas

214-871-8280

Jack Cleaveland Jr. is an experienced insurance regulatory and transactions lawyer who primarily represents insurance companies, agents and other insurance professionals with respect to their business, administrative, and regulatory needs. His practice has focused on the needs of the insurance industry – from handling all types of transactional matters such as formation, licensing, acquisition and dissolution of insurance entities, to assisting them with compliance issues.

Jack’s clients include insurance companies, insurance agents, insurance brokers, managing general agents, reinsurers, and premium finance companies, and his areas of insurance expertise include property, casualty, life, accident, health, surplus lines, and reinsurance. His extensive knowledge and experience on a wide range of issues impacting the insurance industry provides clients with experienced and capable representation in connection with their insurance matters.

Representative Experience

Handled mergers of two affiliated property and casualty insurance companies.

Advised multi-state group purchasing organization on rebating issues, licensing matters and brokerage agreements.

Represented a diversified insurance holding company in the sale of assets of its managing general agency, insurance agency, risk management company, loss control company, nurse case management company, third-party claims administrator, premium finance company, and software development company to one of largest independent insurance agencies in the U.S. for a purchase price of $24 million, plus a potential earnout of another $10 million.

Represented the shareholders of a wholesale insurance broker in the sale of their stock to an insurance holding company for a purchase price of $27 million, plus a potential earnout of another $20 million.

Represented an insurance holding company in the purchase of the stock of a life insurance company for a purchase price of $28 million.

Redomesticated an Arizona domiciled insurance company in Texas by forming and licensing a new Texas insurance company and merging the two entities.

Defended and settled a major enforcement action by the Texas Department of Insurance brought against a multi-line, Fortune 500 insurance holding company alleging illegal redlining. The company was released from the agreed consent order after complying with its negotiated terms.

Obtained the approval of the Texas Commissioner of Insurance of a withdrawal plan of a national insurer with major hurricane exposure seeking to cease the writing of property insurance in Texas.

Formed and obtained a certificate of authority for a new Texas Lloyd’s plan insurer for a national insurance holding company, and obtained approval of the insurer’s policy forms.

Obtained the approval of a Pennsylvania receiver and a Pennsylvania court to enter into a cut-through insurance arrangement between the client insured and its captive reinsurer, avoiding potential exposure of a $24 million double payment.

Consulted with a large, privately owned multi-line insurance agency, with operations in multiple states, regarding contingent commissions and compensation disclosure.

Defended and avoided all charges which were threatened against a multi-line, Fortune 500 insurance holding company by the Texas Attorney General relating to the use of credit scoring.

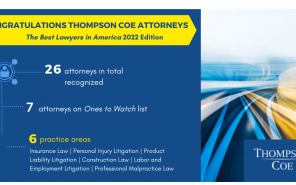

Professional Recognition

Listed for Insurance Law

AV Peer Review Rated

Related Resources

Related Services

Publications & Speaking Engagements

Education, Admissions & Activities

Education

University of Texas School of Law

J.D., 1978

The University of Texas at Austin

B.B.A., 1975

Accounting, with honors

Bar Admissions

Texas

1978

Professional and Community Activities

Dallas Bar Association

American Bar Association

Tort and Insurance Practices Section

Exchange Club of Lake Highlands

Community Services Director, 2000-2002; Secretary, 2002-2004

Dallas Emmaus Community

Lay Director, 1997

Thompson Coe

Management Committee, 2005-2015; Chairman, Insurance Section, 1984-1999

Highland Park United Methodist Church

Vice Chairman, Board of Trustees, 1997-1998; Steering Committee of Capital Funds Campaign, 2000; Finance Committee, 2012-2014