Splash and Crash: Satellite Liability and Insurance

By Benjamin L. S. Ritz • Jan 20, 2022 • In The Houston Lawyer

I. Introduction

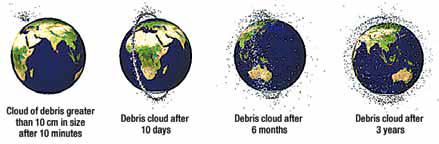

In the movie Gravity, Sandra Bullock plays an astronaut upgrading the Hubble Space Telescope when high-speed space debris strikes her space shuttle and the Hubble. Examples of space de-bris include “dead satellites, discarded equipment, spent rocket boosters, fragments from collisions and explosions, and paint chips.”1 This debris was created when the Russians blew up their defunct spy satellite. While the movie is science fiction, space de-bris is science fact.

On January 11, 2007, China blew up their weather satellite, Fengyun-1C, with an anti-satellite missile weapon, creating over 3,027 pieces of tracked debris. Even the smallest object in space can travel at orbital velocity, which is 17,000 miles per hour at the altitude of the International Space Station. The following day, NASA fired thrusters on its TERRA satellite to avoid a potential collision.2 Now, with mega-constellations of cube-satellites (“CubeSats”) being launched by private and governmental entities, like SpaceX, governments, businesses, and insurers continue to manage the risks of two satellite-related catastrophes: satellites in decaying orbits plummeting to Earth and satellites colliding into one another. At the same time, governments are easing licensing schemes to allow more CubeSats into orbit.

3

3

The majority of satellites are either in low or geosynchronous orbit (“LEO” or “GEO”). Debris small enough and in low enough orbit (200 km) will burn up in the atmosphere or fall to Earth; debris in the mid-range orbit (800 km) will remain for centuries; and debris in geosynchronous orbit (36,000 km) can persist for-ever. Approaches to the debris problem involve tracking, growth mitigation, risk management, and removal.4

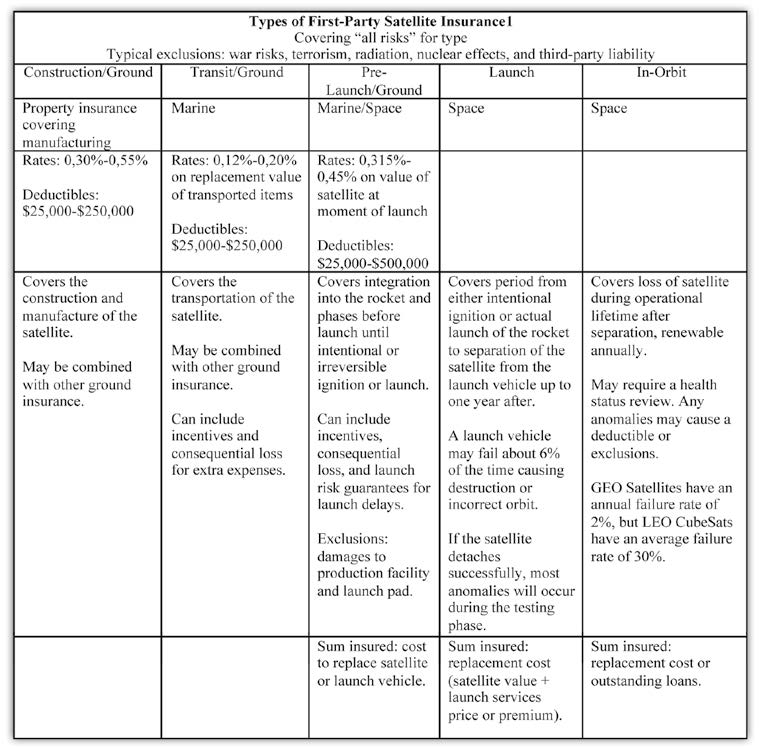

This article will provide a brief overview of risk management for the satellite international liability regime before focusing on U.S. licensing requirements and third-party liability and third-party liability insurance. Next, the article will discuss the three phases of a satellite’s life—ground, launch, and in-orbit—in the context of first-party satellite insurance.

II. International and U.S. National Regime

A. Nations are absolutely liable for falling debris and “at fault” for in-orbit collisions.

Jurisdiction for disputes in space is ad hoc, with a variety of treaties, conventions, and bilateral agreements governing relations between space-faring nations. The well-accepted legal principles in the international space law legal regime are as follows: national super-vision of governmental and non-governmental entities (the Outer Space Treaty, art. VI5), a liability regime (the Outer Space Treaty, art. VII, and the Liability Convention6), a requirement to register space objects nationally and with the U.N. (the Registration Convention, arts. II and III7), and a requirement to return space objects (the Outer Space Treaty, art. VIII and Rescue Agreement, art. V8).

The Outer Space Treaty, art. VII, and Liability Convention, art. I, hold a state liable for damage caused by a space object if the launch occurred in, or was procured by, the launching state. The Liability Convention, art. II, provides that the launching state is “absolutely” liable for damage caused by space objects on Earth or to aircraft in flight. In outer space, liability is determined by “fault,” which is undefined by Liability Convention, art. III. “Fault” may require a minimum of negligence because the Liability Convention, art. VI, exonerates absolute liability if the launching state establishes that the damage resulted from gross negligence by the claiming state. Articles IV and V provide for joint and several liability of multiple launching states. And the Liability Convention, art. XII, sets out the measure of damages as what it would take to restore the harmed party to a condition that would have existed had the damage not occurred.

The Liability Convention, art. IX, states that any damage claim must be presented to the launching state through diplomatic channels within one year of the date of the damages or identification of the responsible party. If they cannot reach a mutual resolution, then a claims commission (essentially, an arbitration panel) is constituted of one member chosen by each state and a chairman chosen jointly by both parties under the Liability Convention, art. XV. Private citizens cannot directly use the Liability Convention to recover for damages, though they might be able to sue under domestic tort laws.9

The Liability Convention has been invoked once. On September 18, 1977, the Russian Cosmos 954 did not boost into a nuclear-safe orbit. Instead, its orbit decayed until it reentered the atmosphere, falling into northwest Canada. While the Soviet Union initially claimed that the satellite burned up on re-entry, a U.S.—Canadian investigation team recovered 12 large pieces, 10 of which were radioactive. Canada brought a Liability Convention claim against the Soviet Union for $6 million in cleanup costs and future damages. They settled for $3 million in 1981.10

B. The U.S. minimizes risks while stimulating industry.

The United States provides guidelines for licensing, risk calculations, cross-waivers of liability, and third-party liability insurance requirements to minimize risks. In response to an on-orbit malfunction of a Westar 6 and a Palapa B2 satellites’ payload assist modules, the Indonesian government sued the manufacturer and won a large settlement.11 Observing this, in 1984, the U.S. enacted the Commercial Space Launch Act (“CSLA”).12 The FAA requires a license for all commercial launches and reentry with-in the borders of the United States, or for launches conducted abroad by a U.S. entity.13 The FAA issues a license when it is convinced that the launch will not jeopardize public health and safety, property, U.S. national security or foreign policy interests, or the international obligations of the United States. These reviews include the policy review, the payload review, a financial responsibility determination, and an environmental review. NOAA and the FCC will also likely need to license the satellite.

As to risk mitigation, Part 440 of the CSLA requires the FAA to determine the maximum probable loss from covered claims by a third party. A licensee is not required to obtain insurance of more than $500,000,000 for third-party claims; $100,000,000 for government claims; or the maximum liability insurance available on the world market at reasonable cost for both third-party claims and government claims if the amount is less than those amounts. The licensee can either obtain third-party liability insurance or demonstrate financial responsibility.14 The government is allowed, subject to congressional appropriations, to pay successful third-party claims in excess of the licensee’s insurance up to U.S. $1.5 billion adjusted for inflation.15 Each licensee must also comply with a complex reciprocal waiver of claims requirement. These cross-waivers essentially eliminate the operator’s own loss, including the loss of its employees, and waive claims against other parties to the space project.16 Part 460 requires similar waivers for the space crew and spaceflight participants. There is no direct regulation of on-orbit operations.17 Other nations vary on whether they impose liability only on the launch operator, only on the ground, or at all stages, including in-orbit.18

Generally, third-party space liability insurance provides indemnification for all sums that the insured shall become legally obligated to pay for bodily injury and/or property damage to third parties arising out of the ground, launch, and in-orbit operations of the spacecraft.19 Perils often include launch vehicle contamination, spent rocket parts returning to Earth or remain-ing in orbit as a collision risk, or damage caused by colliding satellites.20 The list of insureds is broad and includes launching states. Coverage periods are from 12 months to three years. The policy is usually occurrence-based, meaning that it covers losses during the policy period. And because of the cross-waiver requirement, the insurance provides no coverage for li-abilities between the participants in a space project.21

Section 440.13 also provides a few standard conditions of each insurance policy: (1) insolvency does not relieve an insured of its obligations; (2) policy limits apply separately to each occurrence; (3) the policy shall have no deductible unless the deductible is placed in escrow; (4) the policy cannot be invalidated by an act of the insured; (5) exclusions must be specified; (6) the policy shall be primary with-out right of contribution; (7) all provisions save policy limits are severable; (8) each policy must be placed with a reputable insurer licensed in, or subject to, the jurisdiction of the United States; and (9) the policy must include a waiver of subrogation rights against any insured or additional insured, except to claims from willful misconduct.22

Because the risk is low and the claims are few, premium rates are low.23

Recently, the FCC promulgated new rules to streamline processes for a small satellite. The rules reduce the application costs to $30,000 with shorter review periods and a one-year grace period to post a surety bond. This streamlined process is limited to fewer than ten non-geostationary orbit satellites that will be in-orbit no more than six years.24 Also, on October 20, 2021, new FCC rules went into effect requiring greater specificity on collision risks, safety measures, tracking and data sharing, and casualty risk assessments. The FCC considered, but delayed, the adoption of several proposed rules on debris mitigation, indemnification by private satellite operators, and surety bonds for post-mission disposal. Notably, the new rules would have altered collision risk from a single satellite in a constellation to an aggregate probability.

Also, NASA recently published a CubeSat guide providing best practices and specifications of different types of CubeSats here. Violations of best practices and licensing requirements could be a basis for wrongful conduct allegations.25

III. First-Party Space Insurance

Space insurance has a high severity of loss with a limited number of launches per year and a high technical underwriting requirement. Large sums often require multiple underwriters or a syndicated risk. Two of the major factors in determining any insurance premium is the satellite’s cost, any new technology, the cost of the launching vehicle, and the historical performance of the launch vehicle or satellite.26 The first ground and liability policy was issued in 1965 to Early Bird’s IntelSat. From about 2001 to 2012, premiums were at comparatively high levels and more than claims. 2019 and 2020 claims were significant, wiping out most premiums. For example, a Sirius XM-7 satellite, insured for $225 mil-lion, failed when the market income was approximately $452 million, causing AIG to withdraw in November.27 Many operators choose to self-insure by holding reserves, making redundant systems, or, in the case of constellations, launching extra satellites to compensate for this market volatility.

SXM-7, built by Maxar Technologies for SiriusXM, is seen here in Maxar’s manufacturing facility in Palo Alto, Calif.

Image credit: Maxar Technologies

A. Types of First-Party Space Insurance

Other forms of insurance include:

- Launch risk guarantees covering only the launch portion and delays;

- Satellite operations loss of revenue insurance for partial or total failure during the launch or operation period;

- Manufacturer incentive payment insurance to cover the manufacturer if the satellite does not meet specifications;

- Personal accident insurance for astronauts;

- Developing space m insurance; and

- Developing cyber- related insurance for CubeSats.

Note that some insurers will offer packages that cover multiple phases. For example, AXA XL has offered a policy for small satellites that pro-vides coverage from the ground through launch.

B. Key Terms

The following are key terms in insurance agreements.

Loss: The concepts of partial loss, constructive total loss, and total loss are the most complicated and specific portions of the satellite’s definitions. This loss is tied to the degree that the satellite does not per-form to its technical specifications and impairs its intended purpose. The parties will calculate the loss ratio on the specific satellite technology, including the number of redundant transponders, onboard electrical power, fuel reserves, and designed life period. A total loss covers the explosion of the launch vehicle, satellite, or an inescapable improper orbit. If the satellite experiences a 75% to 90% reduction in capability, it will be a constructive total loss allowing full indemnification and transfer of the right of salvage to the insurer. A partial loss is a loss below the threshold for the constructive total loss. A partial loss will partially indemnify a loss to the degree of capacity or life-time lost by the satellite.30 The insured has the burden of proof for loss.31

Misrepresentation: If the insured fails to provide materially accurate information, it cannot recover for the loss. This provision reflects the fact that the loss and other definitions must be manuscripted around that satellite’s specifications. The definition of “material” may require the insurer to show that it would not have issued the exact same policy.32

Material Changes: This provision re-quires the insured to keep the insurer up to date on changes to the satellite’s technology or the insured may be unable to recover for the related loss. To lock in rates, an opera-tor may procure a policy up to two years ahead of the satellite launch. This test is objective.33 For example, a change of the launching rockets can increase liability, al-lowing an insurer to decline coverage.34

Due Diligence: Unlike policies that cover the insured for its negligence, due diligence requires the satellite company to exercise care. The satellite is a high-value asset that the insurer cannot constantly inspect, and once launched, cannot repair.35

Other special policy terms include fuel life and power margins, the intended “commercial communications” purpose, sub-rogation, salvage, named insured’s duties (with sunset clause), a premium payment requirement of 30-days prior to launch for launch insurance, and provisions related to import/export controls.36

IV. Conclusion

Space was governed by an international treaty that originally provided for liability between nation-states. Only nations could reach space. But technology matured, and the United States limited liability between parties on the same space project while requiring minimum insurance based upon estimated risks. At the other end, the general insurance market modified business insurance to cover a business’ own risks pre-launch, during launch, and in-orbit. And if we are careful with the new satellite constellations, we will avoid the situation Gravity, where a shrapnel field wreaked havoc every ninety minutes.

Endnotes

- MATTHEW J. KLEIMAN ET AL., THE LAWS OF SPACE-FLIGHT: A GUIDEBOOK FOR NEW SPACE LAWYERS 215–16 (2012).

- BRIAN WEEDEN, 2007 CHINESE ANTI-SATELLITE TEST FACT SHEET, SECURE WORLD FOUNDATION, available at https://swfound.org/media/9550/chinese_asat_ fact_sheet_updated_2012.pdf.

- Alexander William Salter, Space Debris: A Law and Economic Analysis of the Orbital Commons, 19 STAN. TECH. L. REV. 221, 225–26 (2016).

- Alexander William Salter, Space Debris: A Law and Economic Analysis of the Orbital Commons, 19 STAN. TECH. L. REV. 221, 225–26 (2016).

- “Outer Space Treaty” or Treaty on Principles Governing the Activities of States in the Exploration and Use of Outer Space, including the Moon and Other Celestial Bodies, opened for signature Jan. 27, 1967, 610 U.N.T.S. 205 (en-tered into force Oct. 10, 1967). Article VI provides: “State Parties to the treaty shall bear international responsibility for national activities in outer space, including the moon and other celestial bodies, whether such activities are car-ried on by governmental agencies or by non-governmental entities.”

- OST, art. VII (holding the launching state liable for loss of or damage to property). The “Liability Convention” or Convention on International Liability for Damage Caused by Space Objects, Mar. 29, 1972, 24 U.S.T. 2389, 961 U.N.T.S. 187.

- The “Registration Convention” or Convention on Registration of Objects Launched into Outer Space, Sept. 15, 1976, 28 U.S.T. 695, 1023 U.N.T.S. 15.

- OST, art. VIII (ownership of space objects is not affected by their presence in outer space or their return to Earth, and space objects must be returned to the state of registry). The “Rescue Agreement,” or Agreement on the Rescue of Astronauts, the Return of Astronauts and the Return of Objects Launched into Outer Space, Apr. 22, 1968, 672 U.N.T.S. 119, requires a counterparty to take practicable steps to recover and return a space object to the launching authority.

- See PHILLIP CHRYSTAL ET AL., SPACE DEBRIS: ON COLLISION COURSE FOR INSURERS?, SWISS RE 25 (2011), (exploring the propriety of a Liability Convention claim under California state tort law).

- MATTHEW J. KLEIMAN, THE LITTLE BOOK OF SPACE LAW 123–25 (2013).

- VICTORIA A. SAMSON ET AL., CAN THE SPACE INSURANCE INDUSTRY HELP INCENTIVIZE THE RESPONSIBLE USE OF SPACE?, 69TH INT’L ASTRONAUTICAL CONG. 4 (2018), available at https://swfound.org/media/206275/iac-2018_manuscript_e342.pdf.

- The Commercial Space Launch Act, 51 U.S.C. Ch. 509.

- Title14, Part 413 of the Code of Federal Regulations establishes license application procedures, and other parts describe the different procedures for each type of space activity.

- 14 C.F.R. §§ 400.7, 400.9.

- Id. § 400.19.

- Id. § 400.17.

- The Space Act of 1958, which established NASA, also permits NASA to provide liability insurance for any user of a space vehicle to compensate third-party liability or to indemnity a space vehicle user. The indemnification may not extend to the user’s actual negligence or willful mis-conduct. 42 U.S.C. § 2458b.

- See INSURING SPACE ACTIVITIES, AON RISK SOLU-TIONS 10 (2016), available at http://threecountrytrusted-broker.com/media/Insuring_Space_Activities_whitepa-per.pdf; Jeanne Suchodolski, J.D., L.L.M., An Overview and Comparison of Aviation and Space Insurance, 14 J. BUS. & TECH. L. 469, 488 tbl.4 (2019).

- AON ISB SPACE INSURANCE FUNDAMENTALS, AON INTERNATIONAL SPACE BROKERS 55 (2018), available at https://www.inst-aero-spatial.org/wp-content/uploads/2018-Space-Insurance-Training-IAS-PART-1.pdf.

- INSURING SPACE ACTIVITIES at 11.

- AON ISB SPACE INSURANCE FUNDAMENTALS at 55.

- 14 C.F.R. § 400.13.

- INSURING SPACE ACTIVITIES at 11.

- 47 C.F.R. parts 1, 25.

- See CHRYSTAL, supra note 9 at 26–27 (exploring whether international debris mitigation and FCC licensing requirements could substantiate wrongful conduct by the tortfeasor).

- AON ISB SPACE INSURANCE FUNDAMENTALS at 92–93.

- APSCC, Space Insurance and Risk Management, YOUTUBE (May 24, 2021, 7:54),

- AON ISB SPACE INSURANCE FUNDAMENTALS at 45–48; INSURING SPACE ACTIVITIES at 6–10; BOB WHEARTY, INTRO TO SPACE INSURANCE: FIRST PAR-TY, MARSH & MCLENNAN COMPANIES 10–22 (2015), available at https://d2cax41o7ahm5l.cloudfront.net/cs/speaker-pdfs/robert-p-whearty-marsh-space-projectsusa. pdf; Jeanne Suchodolski, An Overview and Comparison of Aviation and Space Insurance, 14 J. BUS. & TECH. L. 469, 478 (2019).

- CHRISTOPHER T.W. KUNSTADTER, SPACE INSUR-ANCE AND COLLISION RISK, AXA XL 9 (2021), available athttps://indico.esa.int/event/370/contributions/5933/at-tachments/4143/6164/Space%20Insurance%20Update%20 AXA%20XL%20MASTER%20210304.pdf.

- INSURING SPACE ACTIVITIES at 8.

- Pamela L. Meredith, Space Insurance Law—with A Special Focus on Satellite Launch and In-Orbit Policies, 21 THE AIR & SPACE LAWYER 4, 13, 14–15 (2008); see also Certain Underwriters at Lloyd’s, London v. Boeing Co., 385 Ill. App. 3d 23, 40–42, 895 N.E.2d 940, 955–57 (2008) (holding that a reinsurer who had assumed the duties of a direct insurer to defend the insured against the loss of a telecommunications satellite where reinsurers admitted satellite did not meet performance requirements).

- Pamela L. Meredith, Space Insurance Law—with A Special Focus on Satellite Launch and In-Orbit Policies, 21 THE AIR & SPACE LAWYER 4, 13, 14–15 (2008).

- Id.

- Commonwealth Ins. Co. v. Thomas A. Greene & Co., Inc., 709 F. Supp. 86, 87 (S.D.N.Y. 1989); see generally Hughes Commc’ns Galaxy, Inc. v. U.S., 271 F.3d 1060, 1071 (Fed. Cir. 2001) (noting how Plaintiff recovered additional insurance costs after being informed by NASA that it would not be permitted to launch its satellites in the aftermath of the 1986 Challenger disaster).

- Pamela L. Meredith, Space Insurance Law—with A Special Focus on Satellite Launch and In-Orbit Policies, 21 THE AIR & SPACE LAWYER 4, 13, 14–15 (2008).

- WHEARTY, supra note 28 at 27.